E filing should be submitted by those upto 60 years of age with above 2.5 lakh of income before having deduction of Chapter VI A (amount after professional tax, housing loan and interest only deducted from total income) and those of above 60 years old and income of more than Rs.3 lakh. ITR -I can be used by those with salary income, income from house property, bank interest, income like family pension and agricultural income upto Rs.5000/-

Things to Remember before e-filing of Income Tax 2019-20

* If PAN number is not registered in efiling site, it should be registered. Click here for help file

* PAN card can be linked with Aadhaar. Click here for help file

* If 10E Relief was availed as per Section 89 in 2020-21, 10E should be prepared and submitted before efiling. Click here for help file

* If TDS to be get back, then, the bank account details must be pre-validated in E-filing portal before efiling. Click here for help file

* The complete amount reduced as TDS can be checked with Form16 Part A, downloaded and signed by the head of the institution from TRACES. Click here for help file

* If any Fixed Deposit accounts are there with any bank or any such firms, 26AS must be verified and in the case of any other income, that also should be added for tax calculation and TDS deducted and the rest of the amount be remitted before efiling. Click here for help file

Entering into Income Tax e-filing Site

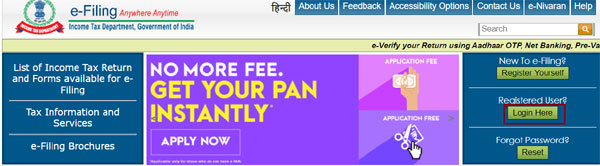

To open the income tax e-filing site, enter http://incometaxindiaefiling.gov.in.

Click log in and enter used id (PAN No) and password, captcha code.

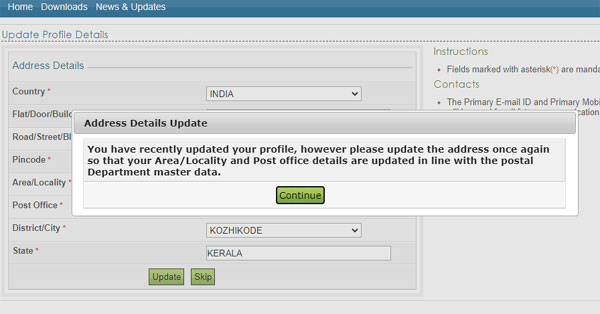

If any changes are to be done, it can be edited in ‘Update Profile Details’. But, it would be changed only when the OTP number in mobile and mail id is entered.

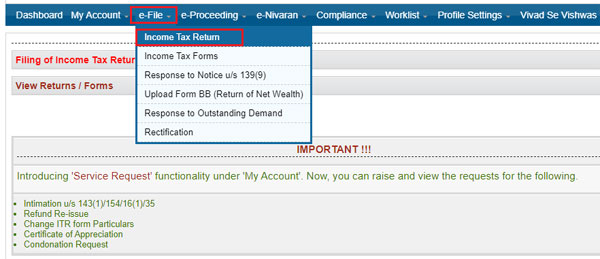

Then click ‘Income Tax Return’ in e-file page.

Select the Assessment year 2020–21

Select ITR Form No– ITR I

Select in Filing type – Original/Revised return

Select ‘Prepare and submit online’ in submission mode

Account details can be seen below, in ‘Bank Account Details’.

Click below ‘Select Account for Refund credit’

While the prefill consent box opens – click ‘I agree’ to reach efiling page.

Various tabs in the Income Tax Portal

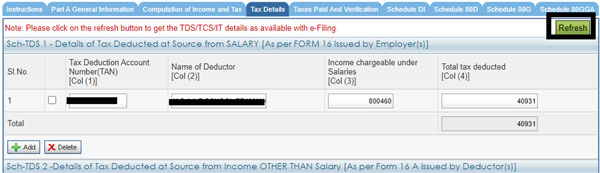

Tax details,

Part A General Information,

Computation of Income Tax,

Tax details,

Tax paid and Verification,

Schedule D1,

Schedule 80 D,

Schedule 80 G,

80 GGA.

Remember to click ‘Save Draft’ to save while entering details.

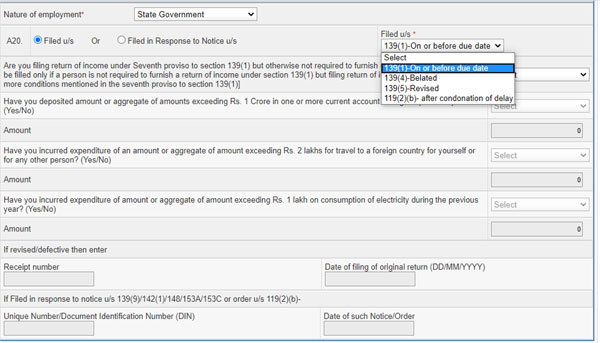

If revising it after filing it already, ‘139(5) Revised’ be selected.

Select ‘No’ for the question that is seen now, Are you filing Returns under seventh proviso of section 139(1)

In ‘Computation of Income Tax’ page, the details can be entered from 2019–20 income tax statement. There are separate pages for deduction under 80G to CMDRF and Medical insurance as per 80 D. It should be done first.

How to do the main entries in Income Tax Portal

Total salary income can be added in B1(a) salary as per section 17 (1) (If any income received which can be exempted as per various statements of section 10, it should be added and then select ‘Nature of Exempt allowance’ in B(ii) and add the amount

Standard deductions Rs.50,000/- be added

Professional tax should be added in u/s 16

(ii)

*B2-entries are for Housing loan and interest only. Select - ‘self occupied’ in ‘Type of House Property’

*Housing loan interest be added in ‘Interest paybale on Borrowed capital’. Don’t enter minus symbol.

Other source income like – Bank interest, Family Pension etc be shown in B3 – Income from Other Sources

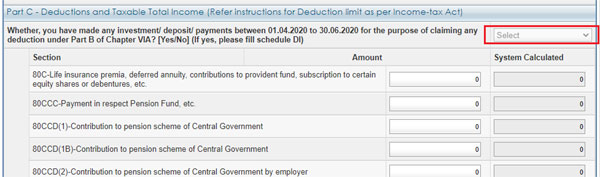

In Part C- ‘Deductions and Taxable Total Income’, enter the deductions under 80C to 80U in relevant boxes.

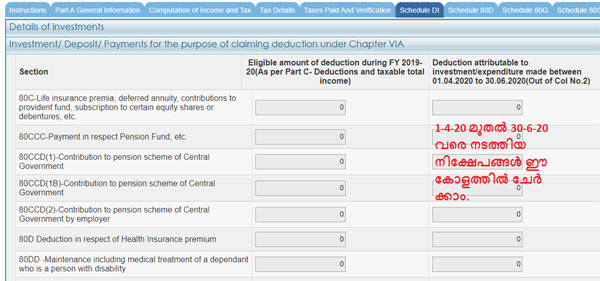

After entry of deductions, if there is any investment / deposit/ payments between 1st April and 30th June 2020. click ‘yes’ or ‘No’ whichever is apt. For deductions of such deposits, select ‘yes’ and add details in ‘Schedule D1’ page (column no.3)

Relief under 10E be added in D6 Relief U/S 89 (1)

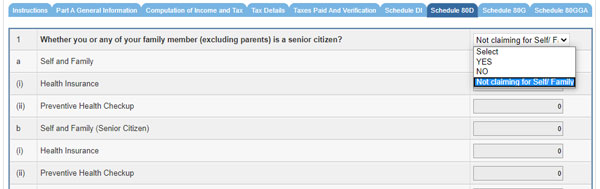

Even though there is deduction or not as per Section 80D, data be entered in the page – Schedule 80D

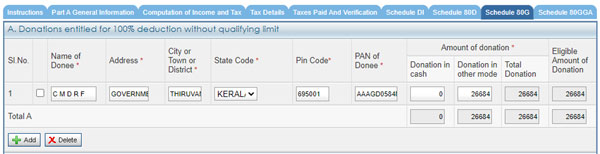

CMDRF Entry Details

Name of Donee – Chief Minister’s Disaster Relief Fund

Address _ Govt of Kerala

City or Town or District – Thiruvananthapuram

State code – Kerala

Pincode – 695001

PAN of Donee – AAAGD0584M

Donations in cash – for donations done by cash only (upto Rs.2000) be done for deductions

Donations done by other mode – Deductions from salary or other such

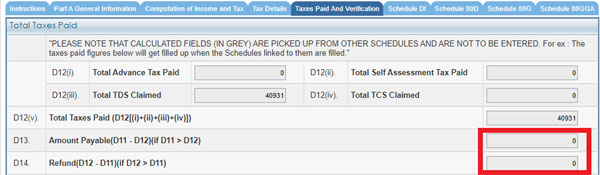

In Tax paid and Verification page, entries in D12 & 14 can be verified and refund amount if any, also can be seen. Enter correctly the bank details.

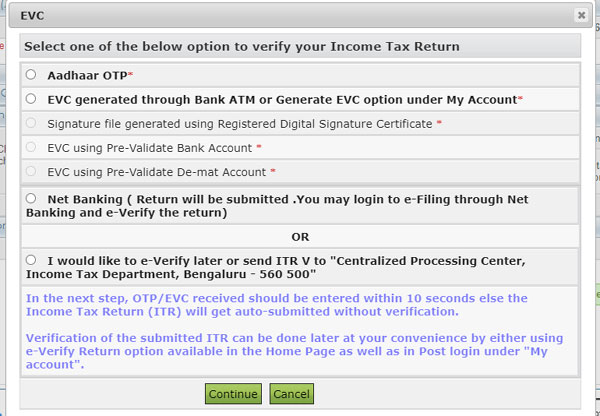

Click ‘Save Draft’ and check the entries made. Then add - Name and Father name in ‘Verification’ and select the suitable one in verification options

'Submit’ button should be clicked only after confirming all entries.

How to create, if password is forgotten?

Click ‘forgot password’ in log in page and enter – User id (PAN no) and captcha code. Then select ‘Using OTP (PINS)’ in the next page click ‘continue’. Select the first option in the case of remembering registered mobile number and mail id else, select ‘New Email id and mobile number’ and enter the mobile number and mail id and select ‘26 AS TAN option’ to add TAN number and click ‘validate’. Now a new page would open. Create a new password and add in the two boxes.

Revised Return After submission

If any corrections are to be done in the ‘Verified Returns’ , ‘Revised Return’ can be submitted in the same way. This can be done till 31st of July, before the completion of Income Tax Dept assessment.

To remember - In the General Information page, select ‘IT Revised 139 (5) in A22- Return file

* Add ‘Revised’ in whether ‘Original or Revised’

* Acknowledgement number of original return and date of filing original return be added in A25 – in under section 139 (5) Revised Return.

Click the help file for more information .